In this article, you will be introduced to everything you need to know about the housing bubble through 5 main questions:

- What is the housing bubble?

- Why do housing bubbles occur?

- Which are the largest markets to be affected by housing bubbles?

- How to overcome the housing crisis?

- What is coming next regarding the bubble?

What is the housing bubble?

A housing bubble is when the costs of housing become very high compared with the average local income. The optimum ratio would be that a property price is equal to or less than 3 times the average annual income in that location. Bubbles often start with high demand and a limited supply of units, forcing the price up. At this point, real estate market shareholders start to pour extra funds into the market to fill this gap and take advantage of the high prices of real estate. However, when the prices become too high for anyone to afford, the demand stops. Meanwhile, the supply of housing increases as developers tried to make money out of the temporarily inflated prices. That’s when the market sees a significant drop in property prices, going back to their original values.

Why housing bubble occur?

First, one should know that a bubble can happen in any sector of trading. It’s a real risk problem in the relation between supply and demand. It can be caused according to human factors such as wars, government policy changes or natural disasters as flooding, fires, etc. Any of these factors can decrease the supply rate forming a bubble. However, in absence of these factors, a bubble can still be created as a result of a general imbalance between supply and demand. For example, if the direction of the government is to build more fancy villas and gated communities at the same time as the community needs more affordable housing this can also result in a housing bubble as there isn’t enough supply of the kind of property that people need. Here are some other reasons for demand increase:

- Sudden increase in population or their demographics due to emigration or other reasons.

- Unfair mortgage systems that result in maximum profit for investors while overwhelming residents with high rents and taxes.

- Pivotal economic activities of suppling more money in the housing sectors and encouraging individuals on replacing rents with homeownership

- Low interest levels that encourage home owning

- High purchasing activities from some buyers as a result of vague, unrealistic future predictions.

One of these factors or all of them combined can cause a bubble in the market. However, markets respond differently to the same factors. Next, we’ll discuss the biggest markets that are affected by housing bubbles.

Where are the largest markets affected by the housing bubble?

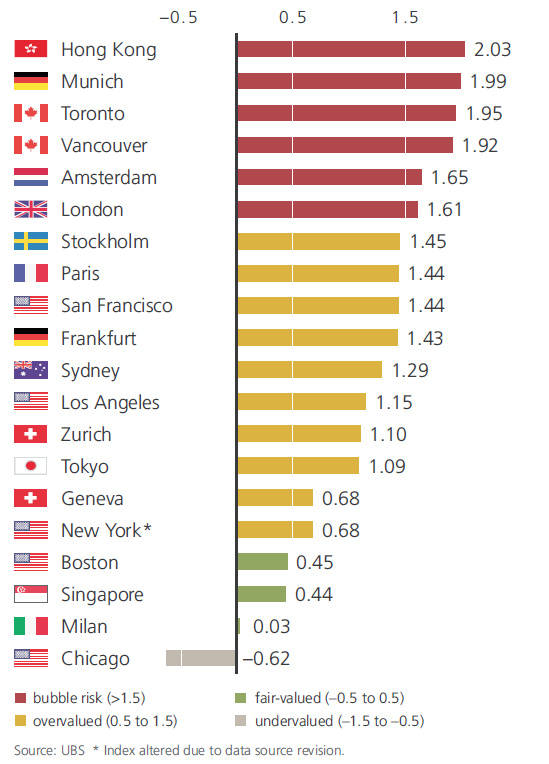

The year 2018 witnessed a big global bubble that affected different markets like Hong Kong, London and some big cities in the United States. According to Real Estate Bubble Index UBS, you need to work 22 years to afford a flat in Hong Kong, 15 years to afford one in London or Paris and around 10 years for one in New York. The following chart explains which cities are facing a bubble risk and for now there are 3 from Europe, 2 from Canada and 1 from Asia. Worth mentioning also that there are 4 cities that score just under the red indicator risk, respectively Stockholm, Paris, San Francesco and Frankfurt.

How can we overcome the housing crisis?

A question like how to solve a housing bubble is very broad to answer. However, we believe there are ways to minimize the effects of such a housing crisis.

- Offering safe loan or mortgage programmes for low-income residents that would not plunge them into debt via high interest levels.

- Providing housing consultation services that can guide each individual to accommodation that matches their income and needs.

- Prevent borrowers or buy-to-let companies from entering the process to make a profit while driving up prices for the average citizen.

- Creation of laws guaranteeing the right of residents to get a property.

- Activate unemployment programs because unemployment is one of the main reasons that refrain tenants and owners from paying and tackle the crisis.

Some of these factors can prevent a bigger housing crisis from developing. Of course, no one wants a second recession like the one that happened in 2008. That’s why we need to closely monitor market performance in order to predict what is coming next.

What is coming next regarding the bubble?

A research report by Zillow revealed that experts predict a big recession to take place in the U.S by 2020. Nearly half of the surveyed real estate firms predicted this recession to start in the first quarter of the year. The reason lies in the huge economic expansion which is considered the second-longest one in American history, creating a bubble that would soon burst. “Housing affordability is a critical issue in nearly every market across the country, and while much remains unknown about the precise path of the U.S. economy in the years ahead, another housing market crisis is unlikely to be a central protagonist in the next nationwide downturn.” Said Aaron Terrazas, senior economist at Zillow.

What we all know is that markets rarely fix themselves. Countries at risk of a new housing bubble should be careful about any triggering factor. Housing is a crisis that impacts almost every other industry. After all, if a person can’t afford a safe space to live in, how can they live happily, build communities or be productive members of society?